Nvidia eases nerves with a profit surge

Nvidia Corporation forecast first-quarter revenue above estimates last night, banking on huge demand for its industry-leading artificial intelligence chips and improving supply chain dynamics.

The company, based in Santa Clara, California, estimated current-quarter revenue of $24 billion, plus or minus 2 per cent, compared with expectations of $22.2 billion.

Total revenue rose 126 per cent on a year ago to a record $60.9 billion, driven by strong sales for AI chips for servers, particularly the company’s “Hopper” chips such as the H100.

Shares in Nvidia, which have risen more than 225 per cent over the past year driven by demand for its AI capabilities, were sold off in recent days in part by profit-taking but also nervousness about its latest quarterly earnings. In late trading on Wall Street after the results the stock was trading $64.69, or 9.6 per cent, higher at $738.63, valuing the company at $1.7 trillion.

The already strong demand for the company’s data centre chips and graphics processing units has continued to grow as businesses scramble to expand their AI offerings. Nvidia’s silicon dominates the global market for AI chips, where it counts the likes of Microsoft, Meta Platforms and Amazon among its customers.

Nvidia’s supply chains, which have been unable to match the soaring demand for its chips, are also improving.

Analysts expect the advanced packaging capacity of Taiwan Semiconductor Manufacturing Company, a major supplier, to improve in the first half of the year. This will allow Nvidia to work through the central bottleneck to its ability to deliver more chips to customers.

Nvidia, which was founded in 1993 and employs more than 27,000 people, reported fourth-quarter revenue of $22.10 billion, beating estimates of $20.62 billion, while net income in the three months to the end of December rose to $12.3 billion compared with $1.4 billion a year ago.

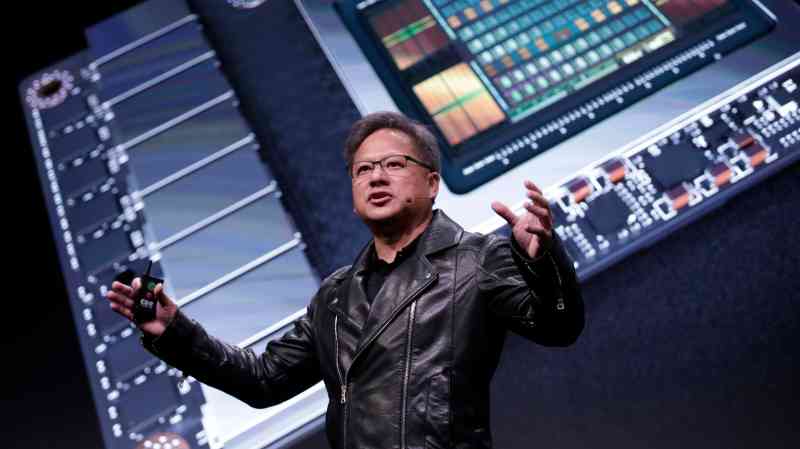

Jensen Huang, co-founder and chief executive, said: “Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.

“Our data centre platform is powered by increasingly diverse drivers — demand for data processing, training and inference from large cloud-service providers and GPU-specialised ones, as well as from enterprise software and consumer internet companies. Vertical industries — led by auto, financial services and healthcare — are now at a multibillion-dollar level.”

Nvidia’s gaming division, which includes graphics cards for laptops and personal computers, was up 56 per cent over the year at $2.9 billion. Graphics cards for gaming used to be Nvidia’s primary business before demand for its artificial chips jumped, and some of Nvidia’s graphics cards can be used for AI.

Nvidia’s data centre division, now its largest source of sales, generated $18.4 billion of revenue, up 409 per cent on the same period a year ago.